The business world was quick to criticize President Biden’s recent pause on new Liquified Natural Gas (LNG) export projects. Instead of blaming Biden for the very reasonable decision to evaluate LNG’s economic, security, and environmental impact, local investors large and small should use this pause to evaluate their continued speculation on such an uncertain industry.

Malvern-based Vanguard, one of the world’s largest asset managers, has acknowledged that climate change poses a material risk to the economy, both because of the direct risks of a warming world and because policies that reduce carbon emissions will change the business landscape. This second risk is exemplified by Biden’s announcement, which was widely viewed as an attempt to appease climate activists during an election year. Given that U.S. support for climate friendly policies has grown across the political spectrum in recent years, long-planned fossil fuel projects face the growing risk that they will never come online. Others may be decommissioned, leaving investors with stranded assets.

Despite its understanding of the problem, Vanguard, the world’s largest investor in fossil fuels, is putting short term gains ahead of the long term safety of its customers and their retirement accounts, not to mention the rest of us. In our region, Vanguard is the top investor in several of the companies potentially involved in the LNG project that Penn America has been seeking to build in Chester. Air Products and Baker Hughes both saw their stock prices tumble after Biden’s announcement.

Vanguard is already deeply invested in polluting industries along the Delaware waterfront, including Trinseo, which spilled latex polymer in Bristol last year, sparking fears that Philadelphia’s water supply would be contaminated. In 2022, AdvanSix spilled phenol in Port Richmond. In the Chester/Trainer area, Vanguard is the #1 institutional investor in Kimberly-Clark and Delta Airlines, which owns Monroe Energy. It has over $1.7 billion invested in the parent company of Covanta, which owns an incinerator residents have been protesting for decades. Vanguard refuses to use its considerable influence to push the corporations in its portfolio in a better direction. In fact, last year Vanguard voted for only 2 percent of climate and environment related shareholder resolutions, an even lower rate than previous years.

Meanwhile, companies are coming under scrutiny, not just from national politicians, but from local communities, like Chester, where people have had enough of the dire health risks that come from living amid so many polluting facilities. That’s why Chester Residents Concerned for Quality Living celebrated Biden’s LNG announcement with a press conference, where founder Zulene Mayfield promised that they would continue to be vigilant in opposing any LNG project. “I want you to understand: we don’t back down,” she warned companies that would not be good for her community. Mayfield was flanked by Chester Mayor Stefan Roots, and State Representatives Carol Kazeem and Joseph Hohenstein, as well as a diverse group of supporters from Chester and surrounding communities.

Because the greatest risk of LNG is to communities and the climate, grassroots opposition is growing and increasingly coordinated. Mayfield acknowledged that people on the Gulf Coast and people in Chester have been supporting each other and will continue to do so. While no permit has been filed yet for the LNG project in Chester, where people learned about it and started organizing to stop it, she stressed that their friends in the Gulf Coast have already been pushed off their land by LNG infrastructure, and are suffering from polluting corporations that are already operating there.

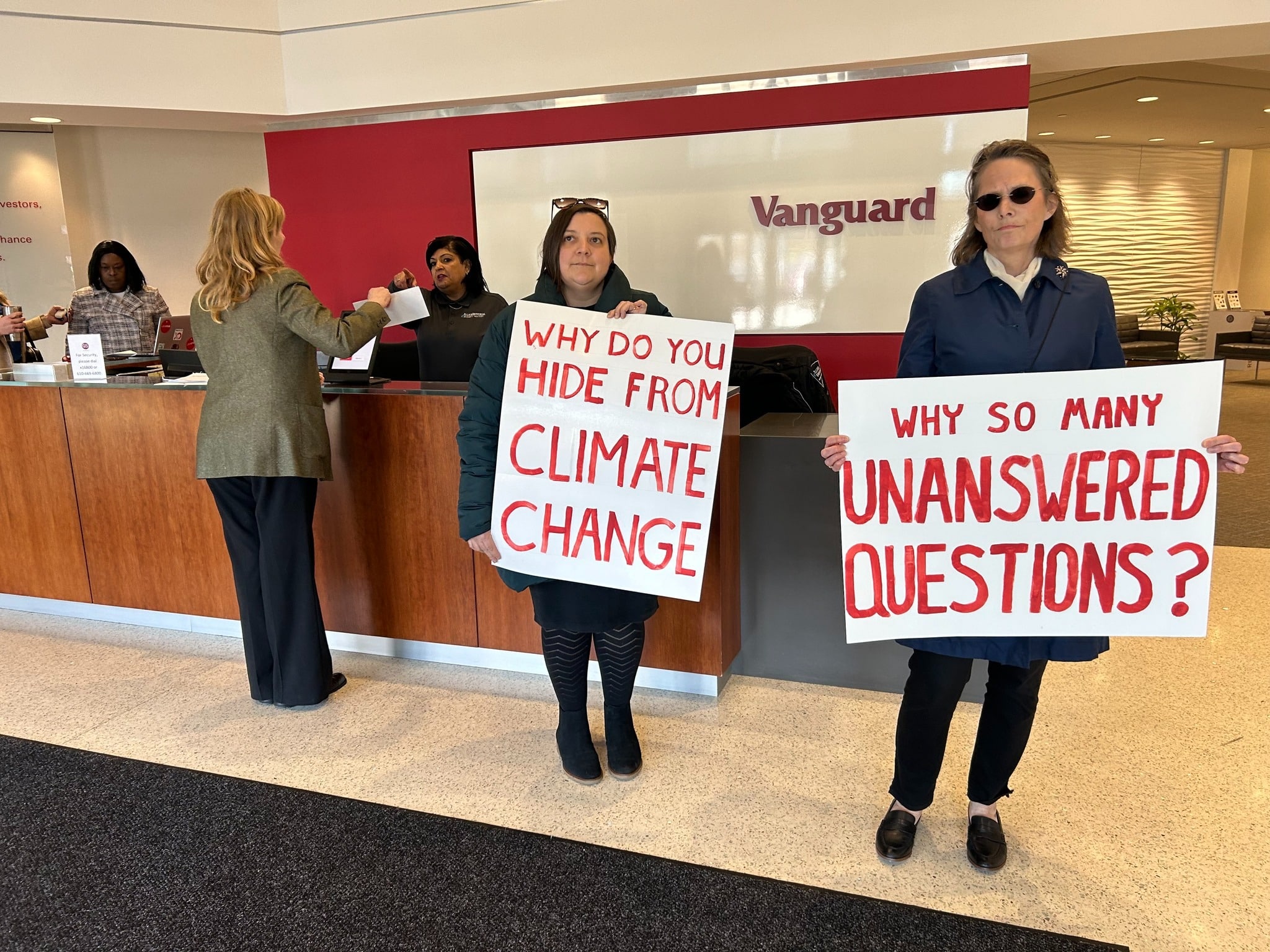

Vanguard’s massive role in enabling such industries is what made it the target of the global Vanguard S.O.S. campaign, which seeks to get the asset manager to take climate risk seriously. In the long run, that should mean getting out of the fossil fuel business entirely, but in the shorter term, there is much Vanguard could do. It could vote for shareholder resolutions on climate and environmental impact. It could make climate friendly funds more accessible and mainstream for investors, instead of only a tiny fraction of its offerings.

As long as it sticks with business as usual, many Vanguard customers will inadvertently put their life savings into LNG-related companies, not realizing just how risky those investments are, in every sense of the word. That’s why Earth Quaker Action Team has started calling on Vanguard customers to move their money as a means of pressuring the asset manager to do better. Since June, they have moved $25 million – a sign that a growing number of investors are realizing that putting their money into fossil fuels is not a good bet.