The following is written testimony prepared for a June 12, 2024 Senate Budget Committee hearing on “Making Wall Street Pay Its Fair Share: Raising Revenue, Strengthening Our Economy.”

Thank you, Chairman Whitehouse, Ranking Member Grassley, and members of the committee, for the invitation to participate in this important hearing. I am Sarah Anderson, Global Economy Director at the Institute for Policy Studies, an independent center for research and action founded in 1963. I also co-edit the Institute’s Inequality.org web site.

The first time I testified before this committee, in 2012, our economy was still recovering from the financial meltdown four years earlier that had thrown millions of Americans out of their homes and jobs. In fact, the U.S. unemployment rate and median household income did not return to pre-crisis levels until several years after that hearing.[1]

Congress and regulators have taken steps to protect our country from the Wall Street greed that was a key driver of the 2008 crash. But financial institutions still extract too much wealth from working families and funnel too much of that wealth into massive executive bonuses that encourage excessive risk-taking – and even financial fraud.[2] And, as we saw with the spate of regional bank failures in 2023, reckless executives can still drive their firms into the ground and walk away with grand fortunes while relying on taxpayer money to contain the damage.[3]

Much more needs to be done to ensure our financial system contributes to a healthy economy and focuses on long-term value creation instead of short-term speculation that might pump up CEO pay but does little for the rest of us. Today’s hearing will examine one important tool for guiding Wall Street in this direction: tax policy.

Next year, the scheduled expiration of several provisions in the 2017 Tax Cuts and Jobs Act will force a major tax debate in Congress. This is an opportunity to take a hard look at Wall Street and consider the following questions:

- Would our tax system be fairer if financial institutions and executives contributed more to the cost of public investments needed for a strong economy?

- Can we use tax policy to discourage financial activities that exacerbate instability and inequality and instead incentivize activities that create long-term value?

In my view, the answer to both questions is “yes.”

- Financial institutions and executives are not contributing their fair share to the cost of public investments needed for a strong economy

Recently enacted laws are funneling hundreds of billions of dollars into public infrastructure and clean energy – investments that will be a boon to Wall Street because more efficient transportation and telecommunications and a more sustainable energy supply will improve the business environment for everyone. But the financial industry, despite being one of the most consistently profitable economic sectors, is not contributing a fair share to the costs of these and other vital public investments, for complex reasons. Here are just a few:

- Big loopholes allow financial firms to pay low effective tax rates

A recent Institute on Taxation and Economic Policy report looked at large U.S. firms that were profitable in every year from 2013-2021. The 44 financial firms in their sample had an average effective federal income tax rate of just 17.7 percent during the four years before the 2017 Tax Cuts and Jobs Act. After that law slashed the corporate tax rate from 35 percent to 21 percent, these firms’ effective rate fell to just 12.5 percent.[4]

Two of the country’s top four banks, Citigroup and Bank of America, paid just a 4 percent effective tax rate during the 2018-2021 period. These global mega-banks have access to a wide array of tax breaks and avoidance strategies, including subsidiaries in notorious tax havens such as the Bahamas and the Cayman Islands — two countries that apply no taxes to foreign corporations’ earnings.[5]

The nature of the financial industry facilitates offshore tax dodging. Transactions in the multi-trillion dollar global derivatives market, for example, can be recorded nearly anywhere in the world to take advantage of jurisdictions with low or no taxes. Small businesses rooted in U.S. communities lack the ability to hide their profits in tax havens.

Provisions in the Tax Cuts and Jobs Act to curb offshore tax avoidance, the “global intangible low-taxed income” (GILTI), have proved largely ineffective.[6] The 2022 Inflation Reduction Act took an important step forward by introducing a 15 percent corporate minimum tax on the largest U.S. corporations (those with profits exceeding $1 billion on average over the preceding three years). As the Institute on Taxation and Economic Policy has pointed out, the minimum tax will not entirely shut down offshore tax avoidance because it will affect only about 150 very large companies, applies to aggregate worldwide profits instead of on a country-by-country basis, and includes other exceptions and carveouts.[7]

Ideally, Congress would build on this progress by approving U.S. participation in the 137-country agreement the U.S. Treasury Department helped broker in 2021 to create a global minimum tax. This tax is more focused on preventing offshore tax avoidance and would affect many more companies.

- The tax code applies zero sales tax on financial market transactions, encouraging unproductive high frequency trading

Most Americans are used to paying sales taxes when they purchase a car, a winter coat, or a restaurant meal. But a Wall Street trader pays no sales tax at all on purchases of millions of dollars’ worth of stocks or derivatives.[8]

This tax-free approach has contributed to the explosion of the algorithm-based high frequency trading that drives about half of today’s U.S. trading volume.[9] The goal of this computerized trading is not to create value but to move at lightning speed to exploit microscopic price differences on different exchanges.

Many financial experts, including a former CFTC chief economist, have warned that high speed trading siphons profits from traditional investors.[10] Bank for International Settlements and University of Chicago analysts estimate that high frequency traders capture as much as $5 billion a year at the expense of other participants in global equity markets.[11]

As the conservative group American Compass describes it, high frequency trading “accomplishes little beyond diverting capital and talent from more productive pursuits.”[12]

- Financial executives enjoy huge windfalls from the preferential tax treatment of capital gains and the “carried interest” loophole

The top tax rate on long-term capital gains (on assets held more than a year) is just 20 percent,[13] while the top rate for regular income such as wages and salaries is nearly twice that, at 37 percent.[14]

As Warren Buffett has famously pointed out, this huge differential means that wealthy Americans, who derive the bulk of their income from investment profits, typically pay a lower tax rate than millions of our country’s firefighters, nurses, small business owners, and teachers.

As of the 3rd quarter of 2023, the richest 1 percent of Americans held nearly half (49.4 percent) of all stocks and mutual funds while the bottom 90 percent held only 13.1 percent.[15] Financial executives are heavily represented among the wealthy investor class. In fact, the Forbes list of the 400 richest Americans includes 134 billionaires whose wealth stems from the finance and real estate industries.[16]

Executives who work for big investment funds – particularly private equity funds – are in an exceptionally privileged position to capitalize on our tax code’s bias in favor of investment income. Under current rules, managers of these funds pay the discounted capital gains tax rate on “carried interest” (earnings tied to a percentage of the fund’s profits). This income actually amounts to compensation for managing other people’s investments and critics have long demanded that it be treated as ordinary income for tax purposes.

The 2017 Tax Cuts and Jobs Act slightly narrowed the carried interest loophole by extending the required asset holding period from one to three years, but this has had limited effect since most private equity funds already hold their assets for more than five years.[17]

The Carried Interest Fairness Act (S. 4123) would require carried interest income to be taxed at ordinary income tax rates, raising an estimated $6.5 billion in revenue over 10 years.[18]

Another proposal, the Ending the Carried Interest Loophole Act (S. 3317), would tax carried interest at ordinary income rates and also prevent fund managers from deferring payment of taxes on wage-like income. The revenue estimate for this bill: $63 billion over a decade.[19]

- The Tax Cuts and Jobs Act further enhanced real estate investors’ privileged tax status

Real estate investors have long enjoyed favored tax status. In a detailed report, Americans for Tax Fairness experts describe how these investors can “delay, minimize, and altogether avoid taxes on their winning investments while mining their losses for big tax write-offs far more easily than other investors.”[20]

The 2017 Tax Cuts and Jobs Act opened up several more loopholes for this segment of the financial industry. The costliest: A last-minute change to the law allowing real estate investors to benefit from a new 20 percent pass-through business income deduction, even though they do not fit the profile of the “small business owner” the deduction was meant to serve.[21] The Joint Committee on Taxation estimates that extending the “qualified business income” tax break to direct investors in real estate and to passive real estate investment trust (REIT) investors will cost $28.9 billion over a decade.[22]

- Tax policy options to discourage financial activities that exacerbate instability and inequality and to incentivize activities that create long-term value

Taxes can be a useful tool for encouraging positive practices while also raising much-needed revenue for public investment. Bipartisan tobacco taxes, for example, have helped reduce smoking rates, saving lives and health care costs and also raising revenue for public health programs. Wall Street recklessness is also a threat to the public welfare. Congress would do well to use tax policy to both raise additional revenue from the financial industry and encourage a stronger focus on long-term value creation and stability over unproductive short-term speculation and excessive CEO pay.

- Curb the excessive CEO pay levels that are driving inequality and undermining business effectiveness

The 2008 financial crisis, when bankers chasing huge bonuses drove our economy off a cliff, is a particularly dramatic example of how corporate pay practices can put us all at risk. In the three years leading up to the meltdown, the top five executives at the 20 biggest bailed out banks had averaged $32 million each in personal compensation.[23]

Public Citizen has examined in detail how financial executives maneuvered to hit their bonus targets while leading the country to disaster. Official analyses of the crisis – and even Wall Street employees themselves — recognized compensation practices as a significant contributing factor.[24]

Congress responded by mandating several executive pay reforms in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. But 14 years later, regulators have still not implemented one of the most important – a ban on incentive compensation structures that promote “inappropriate” risk-taking.[25]

Meanwhile, Wall Street recklessness rages on. In a recent letter urging regulators to finalize the Dodd-Frank pay regulation, Senator Chris Van Hollen and Rep. Nydia Velázquez cited numerous examples of continued compensation-related banking crises, from last year’s regional bank failures to JPMorgan’s London Whale fiasco to the Wells Fargo fake account scandal.[26]

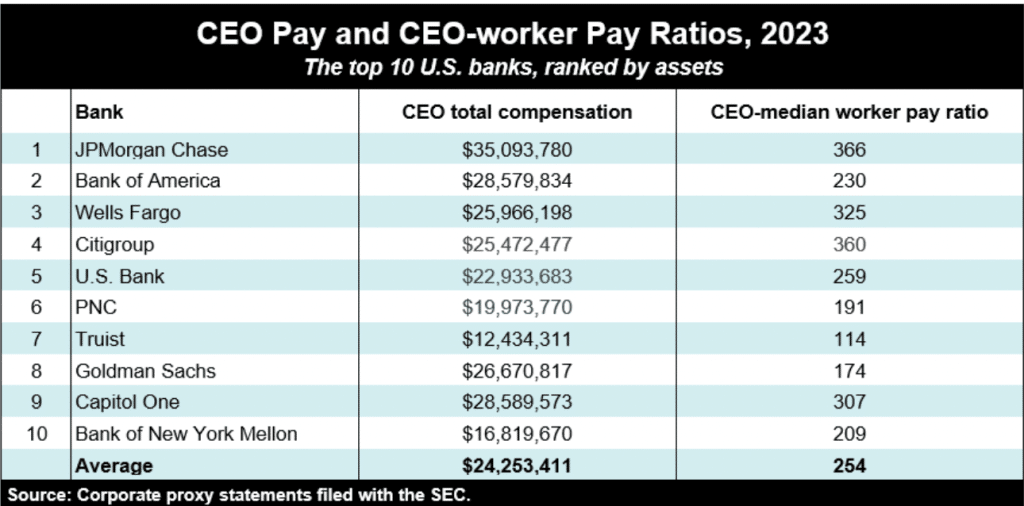

CEO pay at the big banks also remains in the stratosphere. In 2023, total compensation for CEOs of the 10 largest averaged $24.2 million and the average gap between CEO and median worker pay stood at 254 to 1.

While financial sector examples might be the most obvious, Corporate America is rife with tales of outrageous executive pay encouraging behavior that harms workers, communities, and the broader economy. At the Institute for Policy Studies, we have been documenting for decades how reckless practices have perversely rewarded CEOs for slashing jobs, cooking the books, accelerating climate change, and dodging taxes.[27]

The American people want action on executive excess. Poll after poll has found that majorities across the political spectrum view big company CEOs as overpaid, particularly compared to their employees.[28] A Harvard Business School study found that Americans think the right CEO-worker pay ratio runs no higher than 7 to 1.[29] Last year, that ratio was close to 200 to 1.[30]

A May 2024 survey asked likely voters about one possible congressional action: a tax hike on corporations that pay their CEO at least 50 times more than they pay their median employee.[31] Overall, 80 percent of participants supported the idea, including large majorities in every political group (89 percent of Democrats, 77 percent of Independents, and 71 percent of Republicans). In swing states, 83 percent of likely voters gave the proposal a thumbs up.

Pay ratio taxes give companies with huge internal disparities two choices: 1) narrow their pay gaps or 2) face a bigger IRS bill. A company where half of employees earn less than $60,000, for instance, would have to limit CEO compensation to no more than $3 million or raise worker pay to avoid higher taxes. In 2022, average S&P 500 CEO pay hit $16.7 million.[32]

By incentivizing narrower pay gaps, such taxes would encourage practices that are good for the bottom line. Extensive research has shown that extreme gaps between CEO and worker pay undermine corporate performance by lowering employee morale and boosting turnover.[33] Analysis from the Wall Street Journal and the corporate governance firm MSCI also found that higher-performing CEOs actually tended to have lower compensation than their peers.[34]

Rather than an indicator of high performance, massive CEO paychecks reflect a rigged corporate governance system that allows the leaders of our most powerful corporations to extract personal wealth from the workers, clients, and communities that support their firms.

Tax policy options:

Curtailing Executive Overcompensation (CEO) Act (S. 3176/H.R. 6191): Applies an excise tax to publicly traded and private companies that have above a 50:1 CEO-to-median-worker pay disparity. Under the excise tax formula, the rate owed would be proportional to the degree the company’s pay ratio exceeds 50:1 and to the level of the CEO’s compensation. In other words, if a company has a large pay gap, they would owe extra taxes and if they also have extremely high CEO pay, they’d owe even more.[35] Revenue estimate: If the bill had been in effect in 2022, it would have raised more than $10 billion from the Fortune 100 largest U.S. companies alone.[36]

Tax Excessive CEO Pay Act (S. 794/H.R.1979): Ties a company’s federal corporate tax rate to the size of the gap between their CEO and median worker pay. Tax penalties would begin at 0.5 percentage points for companies that pay their top executives between 50 and 100 times more than their median workers. The highest penalty would apply to companies that pay top executives over 500 times worker pay. Revenue estimate: $150 billion over 10 years.[37] The CEO Accountability and Responsibility Act (H.R. 1284) imposes similar tax penalties for large ratios.

- Encourage long-term investment and curb short-term speculation

As noted above, the U.S. government’s tax-free approach to financial market transactions has encouraged an explosion of algorithm-based high frequency trading that adds no significant value to the real economy and siphons profits from ordinary investors.

Even a small tax of just a fraction of a percent on each trade of stocks, derivatives, and other financial instruments would curb unproductive short-term speculation while generating significant revenue.

More than 30 countries, including many with deep and fast-growing financial markets, such as the UK, France, Spain, Italy, Hong Kong, Singapore, Switzerland, and India, currently have financial transaction taxes on particular asset classes. These taxes are a significant source of annual revenue for many countries, including approximately $4.3 billion for the United Kingdom, more than $7.5 billion for South Korea, Hong Kong, and Taiwan, and $1.7 billion for Switzerland. In France, revenue from a very narrow transaction tax amounts to about $2.2 billion per year. [38]

Wall Street lobbyists claim that such taxes would harm mom and pop investors and retirees, but the prime targets would be the high-flyers in the financial casino, the ones with the capital to take advantage of high frequency trading schemes that undercut traditional investors. For most private pension funds and traditional stock-and-bond-holders, the cost of the tax would be negligible — less than typical portfolio management fees.[39] A financial transaction tax would be “quite progressive,” concludes the Washington, D.C.-based Tax Policy Center.[40]

Tax policy options:

Wall Street Tax Act (S. 2491/H.R. 4870): A tax of 0.1% on the fair market value of equities and bonds, and the payment flows under derivatives contracts, with exemptions for short-term debt and initial issuances.[41] Revenue estimate: $752 billion in revenue over 10 years.[42]

Tax on Wall Street Speculation (S. 1990/H.R. 4119): Taxes of 0.5% on stock trades, 0.1% on bonds, and 0.005% on the value of derivatives, with a tax credit for individuals making less than $50,000 and couples making less than $75,000 per year and additional exemptions. Revenue estimate: nearly $220 billion per year.[43]

Additional proposals include a model designed by former Lazard investment banking head Antonio F. Weiss and former Treasury official Laura Kawano for a 0.02% tax on stock, bond, and derivatives trades, with gradual increases to 0.1% in four years[44] and another by Hamilton Project experts for a 0.03% tax.[45]

- Discourage wasteful, CEO pay-inflating stock buybacks

Supporters of the Tax Cuts and Jobs Act claimed that the benefits of the corporate tax breaks would flow immediately to workers in the form of pay increases. White House officials estimated that U.S. workers could look forward to wage bumps of at least $4,000 per year on average.[46] Hundreds of U.S. corporations made similar bonus pledges to their employees.[47]

Instead, the Congressional Research Service found that corporations generally spent their tax windfalls not on worker raises but on stock buybacks.[48] All total, U.S. corporations spent $1 trillion repurchasing their own shares in 2018, the first year the Tax Cuts and Jobs Act went into effect.[49] S&P 500 firms alone spent $806 billion, a massive jump from the $519 billion they spent repurchasing stock in 2017.[50]

The huge post-tax cut outlay changed the norms for buyback spending, and as the economy began recovering from the Covid pandemic, corporations began shattering records once again. While buybacks dipped in 2023 due to recession concerns, Goldman Sachs analysts expect a sharp uptick this year and a historic outlay of more than $1 trillion in 2025.[51]

Stock buybacks are a financial maneuver that artificially boosts the value of a company’s earnings per share, which in turn pumps up the value of executive paychecks. Equity-based pay (stock options, performance stock units, restricted stock, etc…) typically makes up the bulk of CEO compensation. The Economic Policy Institute found that realized equity compensation made up more than 81 percent of total average realized CEO pay at big corporations in 2022.[52]

Spending tax-cut windfalls and other profits on stock buybacks siphons resources from worker wages, R&D, and other productive investments that stimulate long-term growth. Analysts have documented the association between buybacks and worker layoffs, as well as reduced capital investment and innovation and wage stagnation.[53]

As Natalia Renta of Americans for Financial Reform puts it, buybacks are a prime example of “the real economy servicing financial markets” — the exact opposite of Wall Street’s proper role of supporting productive companies and long-term investments necessary for a sustainable and equitable economy.[54]

Stock buybacks were considered stock manipulation and largely banned until 1982, when corporate lobbyists succeeded in pressuring the SEC to legalize them. Members of Congress have introduced several bills to reinstate that ban, including the Reward Work Act (HR 3694).

The Advancing Long-term Incentives for Governance Now (ALIGN) Act (S. 790) would require executives to hold stock-based compensation for at least three years and to hold their stock for 12 months following the announcement of a stock buyback. A 2019 SEC investigation revealed that in the eight days following a buyback announcement top executives sold five times as much stock on average as they had on ordinary days.[55] The Biden administration has also taken a first step towards using the power of the public purse to discourage stock buybacks by giving companies a leg up in the awarding of semiconductor subsidies if they agree to forgo buybacks for five years.[56]

Tax policy options:

Stock Buyback Accountability Act (S. 413): The 2022 Inflation Reduction Act introduced a 1 percent excise tax on the repurchase of corporate stock.[57] This bill would increase that rate to 4 percent. The bill also includes a modification to existing law to prevent corporations from lowering their excise tax base by issuing new stock compensation for top executives.[58] Revenue estimates: The existing 1 percent excise tax is projected to raise $74 billion over 10 years.[59] A 4 percent tax could be expected to generate $238 billion in new revenue over the next decade.[60]

Conclusion

For too long, Wall Street lobbyists have wielded excessive power to shape our tax code in ways that allow this lucrative sector to pay far less than their fair share of all the public services and infrastructure necessary for a healthy economy. The industry has also successfully fought efforts to use tax policy in responsible ways to encourage Wall Street to focus on long-term value creation and sustainability instead of capturing wealth for an elite few.

The 2025 tax debate will be an opportunity to address these problems, as part of a larger overhaul of our tax code that will make our country stronger. This past month, more than 100 civil society organizations (including my own) endorsed a letter urging Congress to embrace a bold, fresh approach to tax policy that “supports public investments, brings good jobs back from overseas, combats harmful concentrations of economic power, reduces poverty and racial disparities, improves health, and directly mitigates the economic risks of climate change and an unsustainable fiscal trajectory.”[61]

The letter specifically calls for “high-income households (those who take home more than $400,000), the extremely wealthy, large profitable corporations, and Wall Street to pay a greater share of their income in taxes than if each of the expiring TCJA provisions were simply allowed to expire.”

Continuing the status quo — or returning to the pre-2017 tax code — will not be acceptable if we are to meet the public investment needs of our time and reverse our country’s staggering economic and racial disparities.

Notes

[1] The U.S. unemployment rate stood at 4.4% in May 2007. It did not fall to this level again until March 2017. Real U.S. median household income stood at $68,610 in 2007 (in inflation-adjusted 2022 dollars). It did not exceed this level again until 2016.

[2] Bartlett Naylor and Zachary Brown, “Inappropriate,” Public Citizen, September 9, 2022.

[3] FDIC, “Final Rule on Special Assessment Pursuant to Systemic Risk Determination,” November 16, 2023.

[4] Institute on Taxation and Economic Policy, “Corporate Taxes Before and After the Trump Tax Law,” May 2, 2024.

[5] See links for a list of Citigroup’s reported subsidiaries and Bank of America’s reported subsidiaries.

[6] Steve Wamhoff, Institute on Taxation and Economic Policy, “Unfinished Tax Reform: Corporate Minimum Taxes,” October 4, 2022.

[8] Exchanges and broker-dealers do pay a negligible Section 31 Transaction Fee on the sale of stocks to help pay the costs of the Securities and Exchange Commission. On May 22, 2024, the rate increased from $8 for every $1 million in equities sold to $27.80 for the rest of the fiscal year to compensate for the SEC not receiving its full-year appropriation until March 2024. The assessment on security futures transactions remained flat at $0.0042 for each round turn transaction.

[9] Nasdaq.com, accessed June 6, 2024.

[10] Nathaniel Popper and Christopher Leonard, “High-Speed Traders Profit at Expense of Ordinary Investors, a Study Says,” New York Times, Dec. 3, 2012.

[11] Matteo Aquilina, Eric Budish, and Peter O’Neill, “Quantifying the High-Frequency Trading “Arms Race”: A Simple New Methodology and Estimates,” Financial Conduct Authority, January 2020.

[12] “Rebuilding American Capitalism: A Handbook for Conservative Policymakers,” American Compass 2023.

[13] Higher-income taxpayers (married couples with annual gross income over $250,000 and singles over $200,000) also pay a 3.8 percent net investment income tax on capital gains. Tax Policy Center, “Briefing Book, How Are Capital Gains Taxed?”

[14] Higher-income taxpayers also pay a Medicare surtax of 0.9 percent.

[15] Federal Reserve Distributional Financial Accounts, accessed June 6, 2024.

[16] Institute for Policy Studies analysis of Forbes data.

[17] “Key Elements of the U.S. Tax System,” Tax Policy Center, January 2024.

[18] Press release, U.S. Senator Tammy Baldwin, April 15, 2024.

[19] Ending the Carried Interest Loophole Act, Senator Ron Wyden.

[20] “Fair Taxes Now,” Americans for Tax Fairness, April 2019.

[22] “Trump Tax Law Hurts Homeowners and Helps Real Estate Developers,” Democratic Staff Report Committee on Oversight and Government Reform, U.S. House of Representatives, July 2018.

[23] Sarah Anderson, John Cavanagh, Chuck Collins, and Sam Pizzigati, “Executive Excess 2009: America’s Bailout Barons,” Institute for Policy Studies, September 2, 2009.

[24] Bartlett Naylor and Zachary Brown, “INAPPROPRIATE: Banker Scams Continue as Washington Fails to Reform Pay as Mandated by 2010 Law,” Public Citizen, September 1, 2022.

[25] Letter to the Regulators: Emphasizing the Urgent Need to Implement Key Executive Pay Rule, Dodd-Frank Act Section 956, Americans for Financial Reform and other civil society organizations, May 09, 2024.

[26] Press release: “Van Hollen, Velázquez Urge Regulators to Crack Down on Bank Executive Pay Schemes That Incentivize Risk,” May 15, 2024.

[27] See Institute for Policy Studies annual “Executive Excess” reports.

[28] Tanya Jansen, “Millennials, Gen Z Workers Want to Know What Their CEOs Make,” beqom, February 26 2019.

[29] Sorapop Kiatpongsan and Michael I. Norton, “How Much (More) Should CEOs Make? A Universal Desire for More Equal Pay,” Perspectives on Psychological Science, 2014.

[30] Mae Anderson, Paul Harloff, and Barbara Ortutay, “CEOs made nearly 200 times what their workers got paid last year,” Associated Press, June 3, 2024.

[31] Data for Progress survey conducted April 19-22, 2024.

[32] AFL-CIO Executive Paywatch, accessed June 6, 2024.

[33] Institute for Policy Studies Inequality.org web site page on CEO pay resources.

[34] Theo Francis and Joann S. Lublin, “CEO Pay Shrinks 4.6% but Offers Weak Reflection of Performance,” Wall Street Journal, June 2, 2016.

[35] Press release, “Whitehouse, Lee, Ocasio-Cortez Introduce Legislation to Increase Worker Pay, Rein in Runaway CEO Compensation,” November 2, 2023.

[37] Press release, “NEWS: Sanders and Colleagues Introduce Legislation to Combat Corporate Greed and End Outrageous CEO Pay,” January 22, 2024.

[38] Gunther Capelle-Blancard, “The taxation of financial transactions: An estimate of global tax revenues,” Centre d’Economie de la Sorbonne University Paris, May 10, 2023.

[39] Michael Edesess, “Vanguard opposes a tax on Wall Street its founder John Bogle favored — and the reason may surprise you. Financial transaction tax won’t harm Main Street investors, but does impact traders and big shareholders,” Marketwatch, Sept. 3, 2020, and Dean Baker, “Financial Transactions Taxes: A Wall Street Levy that Won’t Affect Pension Funds,” Center for Economic and Policy Research, October 30, 2020.

[40] Leonard E. Burman, William G. Gale, Sarah Gault, Bryan Kim, Jim Nunns, and Steve Rosenthal, “Financial Transaction Taxes in Theory and Practice,” Tax Policy Center, January 2016.

[41] Press release, “Schatz, Hoyle Reintroduce Legislation to Tax Wall Street, Reduce Economic Inequality,” July 26, 2023.

[42] “Options for Reducing the Deficit: 2021 to 2030,” Congressional Budget Office, December 2020.

[43] James Heintz, Thomas Herndon, and Robert Pollin, “The Revenue Potential of a Financial Transaction Tax for US Markets,” International Review of Applied Economics, July 30, 2018.

[44] Antonio Weiss and Laura Kawano, “A Proposal to Tax Financial Transactions,” Brookings Institution, January 2020.

[45] Kimberly A. Clausing and Natasha Sarin, “The coming fiscal cliff: A blueprint for tax reform in 2025,” The Hamilton Project, September 27, 2023.

[46] Brian Faler, “The $4,000 question,” Politico, October 12, 2017.

[47] Kathryn Kranhold, “Big businesses promised wage hikes from Trump’s tax cuts. What actually happened?” NBC News, Feb. 12, 2019.

[48] Jane G. Gravelle and Donald J. Marples, “The Economic Effects of the 2017 Tax Revision: Preliminary Observations,” Congressional Research Service, May 22, 2019.

[49] Matt Egan, “Corporate America gives out a record $1 trillion in stock buybacks,” CNN.com, December 17, 2018.

[50] S&P Global press release, March 15, 2022, and S&P Dow Jones Indices, March 24, 2020.

[51] “Goldman Sachs expects U.S. buybacks to top $1 trillion in 2025,” Reuters, March 7, 2024.

[52] Josh Bivens and Jori Kandra, “CEO pay slightly declined in 2022. But it has soared 1,209.2% since 1978 compared with a 15.3% rise in typical workers’ pay,” Economic Policy Institute, September 21, 2023.

[53] William Lazonick, “Stock buybacks: From retain-and reinvest to downsize-and-distribute,” Brookings Institution, April 17, 2015. and Lenore Palladino, “Financialization at work: Shareholder primacy and stagnant wages in the United States,” Sage Journals, June 22, 2020.

[54] Natalia Renta, “Congress Takes Historic Step to Tax Stock Buybacks,” Inequality.org, August 10, 2022.

[55] Jerry Useem, “The Stock-Buyback Swindle,” The Atlantic, August 2019.

[56] Sarah Anderson, “Corporations That Forgo Stock Buybacks Have a Better Chance of Winning CHIPS Subsidies. Let’s Expand That Precedent,” Inequality.org, October 31, 2023.

[57] Natalia Renta, “Congress Takes Historic Step to Tax Stock Buybacks,” Inequality.org, August 10, 2022.

[58] Press release, “Brown, Wyden Introduce Legislation to Increase Tax on Stock Buybacks,” February 14, 2024.

[59] “Tax Fairness Reforms in The Inflation Reduction Act,” Americans for Tax Fairness, September 13, 2022.

[60] U.S. Treasury, “General Explanations of the Administration’s Revenue Proposals for Fiscal Year 2024 – TABLES.”

[61] Tax letter to Congress, May 21, 2024.