How can we measure what our leaders value? One way is to look at their budgets.

On March 9, President Biden rolled out a budget proposal that he’ll ask Congress to consider. Presidential budget proposals seldom pass in the form they’re presented, but they offer clues about what the White House is willing to fight for.

By investing in jobs and families, protecting Social Security, and strengthening Medicare, this one reflects the things most of us value. And it would do all this while reducing the federal deficit by $3 trillion over the next decade.

Here’s a look at the domestic spending in Biden’s budget plan.

The budget proposes $600 billion over 10 years in child care, early childhood learning, and support for families. That includes the wildly popular Child Tax Credit expansion that cut child poverty nearly in half, as well as long-overdue funding for paid family medical leave.

These investments would lead to greater success for kids throughout their lives. They would make it easier for parents to work and care for their families. And the 10-year cost for all of it falls substantially below what we spend on the Pentagon in a single year.

In an age of skyrocketing college costs, Biden’s budget would also increase higher education affordability with a modest increase in Pell Grants. In the midst of a serious affordable housing crisis, it proposes critical rental assistance and additional housing voucher funding.

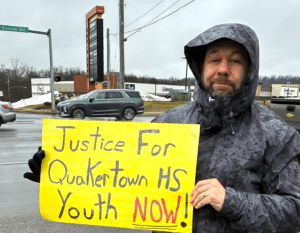

READ: Bucks County Has Two Millionaires For Every One Homeless School Child

It would also help foster kids transition to a safe and productive life once they age out of the system. It would support low-income veterans’ families. And it raises investments in clean energy by 26 percent.

On the health care front, the budget shores up Medicare for at least 25 years. It reduces prescription drug costs. It permanently extends pandemic-era health subsidies so struggling people can afford care. And it expands health coverage options for the 2 million people who lack insurance because they live in one of the 12 states that refused to expand Medicaid coverage under the Affordable Care Act.

How does it do all this while reducing the deficit? Simply by closing unfair tax loopholes for corporations and the very wealthy, which would raise $4 trillion in revenues over the next 10 years.

READ: Billionaires Are Bad For Democracy

The Biden plan would require the Elon Musks of this country to pay at least as much in taxes as you, a teacher in your district, or your local firefighter. Currently, billionaires pay an average of 8 percent in taxes, while the rest of us pay 14 percent. Some billionaires and big corporations pay nothing at all in taxes.

This plan makes sure billionaires pay at least 25 percent of their income in taxes. And it would nearly double the tax that wealthy investors pay on their investment income.

On the military side, however, the news is less welcome.

Biden’s budget calls for yet another increase in our already obscenely bloated defense budget. During a time when the U.S. isn’t embroiled in any war, that number should be going down, not up. And the savings should be put towards families and workers.

As the National Priorities Project explains, more than half of all discretionary spending in this proposed budget goes to the military, and fully two-thirds goes to a combination of programs that could broadly be considered militarized. That leaves just one third for all those worthwhile domestic programs.

More needs to be done for the nearly 140 million people who struggle to make ends meet in the wealthiest nation in the world. Biden’s proposed social investments would be a solid step in the right direction — they just need to be a bigger part of the whole budget.

This op-ed was distributed by OtherWords.org.