One of the most popular questions asked during tax season is where exactly our money is going. At the federal level, most of taxes go to Medicaid and Social Security, as well as the U.S. military. What is often overlooked, however, is state taxes that go to organizations we rely on every day. So who makes the decisions about where our state taxes go? Enter the State Treasury.

There isn’t much in the PA Constitution about the role of the State Treasurer. The treasurer can serve two four-year terms but cannot run for the position after that. The biggest thing to note is that the, “State Treasurer shall not be eligible to the office of Auditor General until four years after he has been State Treasurer.”

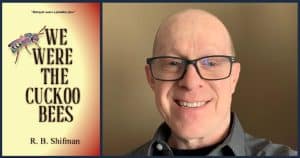

MEET THE CANDIDATES: Erin McClelland | Stacy Garrity

This is not to say that being a State Treasurer is not an important job. Their job is to look over all of the taxes and other types of revenue that the state collects. The Treasurer then decides which non-profits, municipal governments, and financial projects the state will give money to. The Treasury department keeps track of where the money is spent, and posts it for the public to see.

According to the 2024-25 fiscal year, the PA treasury department appropriated over $47 billion dollars to different departments. $18.96 billion went to Human Services, which includes Community HealthChoices (given to individuals 21 or older who are on both Medicaid and Medicare or are receiving full time care through Medicaid), and County Child Welfare. $18.19 Billion was also appropriated to Education, most of which went to basic education funding.

The Department also keeps tabs on PA’s economic growth and savings for economic downturns. One of these is a rainy day fund, which would be used if there was less tax revenue so the Treasury Department could still spend money on social services without having to cut funding. According to the department, PA currently has enough money to expend funds for 53 days in 2025. This is a dramatic increase from 6 years ago, when the state only had enough saved up for less than a day in their rainy day fund.

Another change that the department has made is to track unclaimed properties in the state. This includes properties such as dormant bank accounts, forgotten stocks, and abandoned safe deposit boxes. The Treasury Department says that there is $3.02 billion dollars in unclaimed property in the state. In Bucks County alone, there are over a million unclaimed properties, totaling close to $142 million dollars.